August 2022

Leaders Real Estate will soon launch a blockchain fund to better meet the dental industry’s real estate needs.

Blockchain technology platforms are disrupting the real estate market by facilitating fast, secure digital transactions without going through a third-party brokerage. They are about to have a beneficial impact on DSOs.

"Austin Hair, Business Development Manager of Leaders Real Estate, is here at Dykema’s 2022 Definitive Conference for DSOs, and I am delighted to interview Austin so we can learn about their blockchain fund and how it will work," says Patient Prism's Amol Nirgudkar. We also want to know how Leaders Real Estate excels in finding practice locations for DSOs.”

Leaders Real Estate provides a range of services for dental groups

Amol Nirgudkar: Austin, tell us a little bit about your services at Leaders Real Estate and how you are helping the DSO community.

Austin Hair: We're really a data and analytics company at heart that found a way to monetize what we do for real estate transactions instead of charging exorbitant fees. We focus on selecting sites for development, and we have found opportunities to purchase sites, develop them, and then lease them to dental groups. We also purchase dental offices and lease them back to private dentists and DSOs who do not want to own them.

Amol Nirgudkar: I’ve seen this frequently with private practices; the dentist still wants to run the business but is interested in selling the office and leasing it back.

Austin Hair: REITs are historically the way that most doctors have sold their real estate because there are great tax advantages. The problem is that 90% of their cash flow gets paid out by dividends. Cash flow is good, but ROI is not as great. That's the trade-off.

Also, you have no liquidity because your shares are tied up. You must sell them to an accredited investor. You must go through an intermediary. And so, we are developing a blockchain real estate fund to improve liquidity and ROI. There's no taxable event when you sell real estate to the blockchain fund because you're exchanging real estate for shares in the fund. You're participating in the appreciation of the building, and you're not having the headache of managing it anymore. If you do have a liquidity event or a capital requirement, you can sell as many shares as you want.

Leaders Real Estate is tokenizing ownership on a blockchain platform

Amol Nirgudkar: Tell us more about that blockchain real estate fund and the tokenization of ownership.

Austin Hair: Blockchain technology is a digital ledger, and tokens are a way of quantifying shares on the blockchain, so it works for all intents and purposes like a regular fund but there are advantages. When we acquire your real estate, you receive tokens in the fund. For example, you might be given 100,000 shares initially valued at $10 a share, based on selling a one-million-dollar building to the fund. The benefit of having tokens over shares is you no longer must sell to an accredited investor.

Each token represents a percentage of that building. The tokens are the means by which you transfer value back and forth. We’re creating our own token backed by real estate.

Amol Nirgudkar: Who will buy that token when you need liquidity?

Austin Hair: Investors. On the market now are people investing in different things on cryptocurrency platforms. You might know someone, say a friend of yours, who wants to get into real estate. Let’s imagine your friend knows you sold your real estate to the tokenized blockchain fund, and your friend wants to buy some of it. Your friend can set up an account and buy the tokens you want to sell, transfer money to you on the account, and then you transfer the tokens to your friend. You are buying and trading tokens with whomever you want.”

Amol Nirgudkar: If I have $1,000,000 of real estate, and I exchange that for $1,000,000 worth of tokens, is that a taxable sale?

Austin Hair: You don’t owe taxes until you cash out tokens by selling them on the platform. Like a stock exchange fund, the value of your tokens at the time you sell them is based on the value of the total fund.

Amol Nirgudkar: Setting up a tokenized real estate fund is a complicated process both technically and legally, isn’t it?

Austin Hair: Yes. We started the process in January. It's been very arduous with the lawyers, legal fees, and the developers. We’re hoping to launch in the fall, but it could be later. We're not ready to acquire real estate in the fund right now. That being said, we still actively acquire real estate that is not through the fund. If a doctor wants to sell a practice to a DSO, we can broker that transaction in 60 days.

Leaders Real Estate can help DSOs with site selection right now

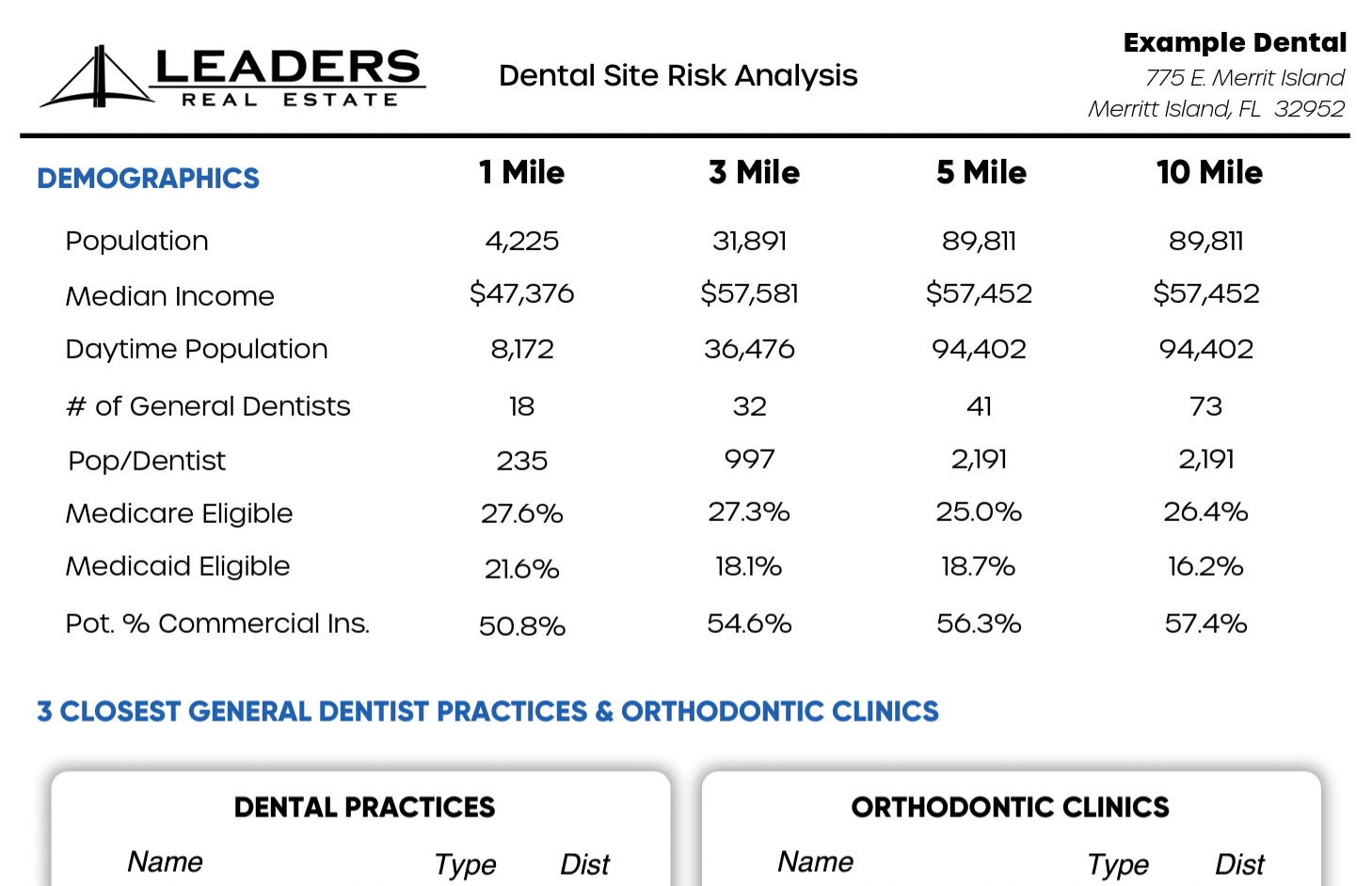

Austin Hair: Every group has its own patient avatar; so, we create a profile that fits the group. Then we look at all the different anchor tenants in the area. We're largely looking at grocers and we rank them based on their compatibility with your clients. For example, within your trade area, how does the Target store rank with your demographic of patients? We’re also going to plot your competition. If a competitor has an exclusive with an anchor tenant, we’ll see how close we can get to that tenant if the demographic is excellent. A lot of considerations and analytics go into site selection, and it is an art just as much as it is a science when we apply our perspective shaped over years of experience.

We want to be the third-party real estate department for DSOs without the overhead. So, if you're a group and you're growing, we'll waive the fees. It can be anywhere from $5,000 to $10,000 to do an analysis, but we'll waive those fees if we will earn the brokerage fees. It wouldn't cost you anything as a group to have us do a selection for you.

Amol Nirgudkar: During my years as a CPA working with professional practices, I know firsthand that there are lots of details in an agreement that clients don’t understand and didn’t realize they could negotiate. That’s why you need experts like Austin Hair. Instead of being taken advantage of, you want to take advantage of opportunities. Whether you are selling your office, building an office, leasing an office, or interested in tokenized real estate sales and investment, Austin is a great guy to know – and he’s a ninja warrior!

Download Leaders Competitive Analysis Chart here >

To Contact Austin Hair: Email ahair@leadersre.com

What is a blockchain real estate fund?

Blockchain and smart contracts are technologies that have been around for quite a while to maintain computer-coded versions of purchase and sale agreements and financing agreements.

Blockchain technology is a decentralized ledger system (also known as a distributed ledger system), which can be used for recordkeeping and to manage agreements between parties.

Each party to a transaction is assigned a digital identity on the distributed ledger through which each party can view and verify each contract fact, for example, the dollar amount, chain of title, zoning permit, and so on.

Each time the participants verify and finalize the information associated with an agreement, it is recorded as a “block” on the blockchain. Each finalized block is time stamped and immediately becomes a permanent record.

Buyers and sellers still need to negotiate the terms of the deal on which the smart contracts are based but this decentralization of information creates transparency and provides an efficient means to find errors before they become difficult to correct.

Blockchain technology is already bringing real improvements to the traditional operation of real estate funds. A blockchain platform not only improves the management of the relationship between the real estate fund management company and its investors but also guarantees more reliable access to the data which serves as the basis for the valuation of the assets.

Cash flows from a building can be entered on the blockchain, which then becomes a reliable and dynamic source of information so the performance of an asset can be measured regularly.

Blockchain technology platforms not only allow better distribution of fund shares when the fund is created but also facilitate over-the-counter trading in a secondary cryptocurrency market.

Real estate investing and blockchain technology are converging with the “tokenization of real estate” to create real estate investment funds like the one that Leaders Real Estate is currently developing.

Real estate asset tokenization involves the creation of virtual tokens that represent ownership shares of real estate. When you own a token, you own a share of the asset to accrue ROI and to sell when you need capital or want to cash out.

The advantage of tokens over shares is you no longer need to sell to an accredited investor. With the blockchain, two investors can connect on a platform, finalize their exchange then notify the real estate fund management company. Once the transaction has been validated by the latter, the property register is automatically updated.

Subscribe to our blog for the latest updates

By submitting this form you will be receiving our latest updates on post. We're committed to your privacy. Patient Prism uses the information you provide to us to contact you about our relevant content, products, and services. You may unsubscribe from these communications at any time.

- Recent

- Popular

.svg) Share

Share.svg) Tweet

Tweet.svg) Post

Post.svg) Mail

Mail